Importing A Classic Car From Europe After Brexit

Youngtimers in Europe may be less attractive to UK buyers as a result. There are new rules for importing and exporting goods between Great Britain and countries in the EU.

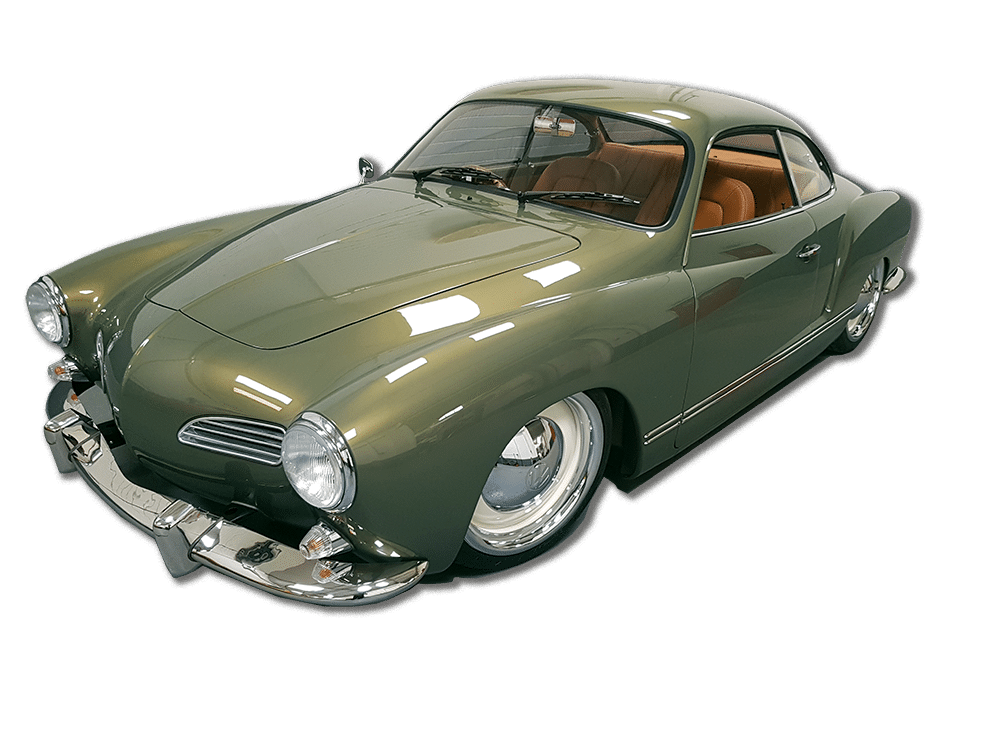

Custom Cars Custom Car Makers Uk

The VAT charge is payable when importing into Northern Ireland as the North is to remain within the EU customs territory.

Importing a classic car from europe after brexit. It has spoken to various industry insiders to better understand their experience adapting to. You may not dispose of a vehicle that has been admitted tax and duty-free for a period of 12 months following the date of its entry into France. However there are some exceptions.

Yes for the duration of the transition period UK-EU trade will continue and no extra charges or checks will be introduced. As an example if selecting the latter the insurance premium pricing for 100k of a classic car cover would be a calculation based on 40 of the value and the duration of the carnet. Existing non-EU rules could see the importing of classic vehicles come with a hefty 20 VAT charge together with an additional 10 import duty.

Tell HM Revenue and Customs HMRC within 14. Due to all the regulations and nuances you tend to read across the whole spectrum of the classic car world. Car Imports by a Company From 1st January 2021 after the transition period if you are importing the vehicle to the UK as a VAT registered company you will need to.

Whether youre completing customs declarations yourself or have an intermediary to do it for. That means completing a. What happens after that is anyones guess.

This can either be a refundable deposit of 40 of the vehicles value or a non-refundable insurance premium to cover the 40 proportion of the premium. You can pay an importer or shipping company to do them for you. The charges come as the prices of classic cars and motorcycles have soared in.

Getty This is mirroring the cost of buying and importing classic vehicles from the rest of the world Under current. Buying a classic car from Europe and importing it to the United Kingdom has become more complex and expensive thanks to Brexit. Importing a vehicle from Great Britain GB or Northern Ireland All motor vehicles imported from the UK into the State must be registered within 30 days of the date they first arrive.

There are several implications of full Brexit on bringing a UK car to France and registering it with French plates. A couple of years ago we released an article on how imports and exports of classic cars can be a daunting and challenging process. So if youre looking to buy a car or parts for you classic from Europe or are selling to someone within the EU nothing changes until at least 1 January 2021.

Cars imported to the Republic from either the North or Britain will. The extra tariffs will only be added on cars imported from the EU Image. According to Revenue importation of a vehicle from Britain is now treated as an importation from a third country that is a non-EU country.

The report into the affect of Brexit on the classic car market has been collated by insurer Hagerty. As the UK government flexes its muscles the result has been more paperwork more taxes and more frustration for enthusiasts dealers and auction housesSince the changes went into effect as the new year started its not entirely clear all the. Rule Changes for Importing and Exporting a Classic Car to the EU After Brexit.

Firstly French VAT at 20 may be payable on a car imported from a non-EU country. VRT is charged in most cases when a vehicle is registered in the State. Cars built in the EU are exempt from import duty scrapping a potential 10 charge and the margin scheme has been reintroduced for used cars sold into Northern Ireland meaning no VAT will be payable.

Classic car buyers looking to snap up a stunning European bargain can expect to pay up to 30 more once the UK leaves the EU. Auction houses are slightly different but largely covered by the same rules. In theory import customs duties of 10 could also be due if the car was not made in the UK under the rules of origin regulations in the Brexit future.

Your vehicle must be imported into France within 12 months of the date oftransfer of your main residence to France. You must complete certain steps as soon as you bring a vehicle into the UK permanently. Prior to Brexit Vat was due on privately imported used UK car imports only if the imported car was less than six months old or had mileage under 6000km.

Renault 10 Major Photos News Reviews Specs Car Listings

Pin On Peykan Is Awsome پیکان خفن است

The Mazda 323 Autonspire Oude Auto S Mazda Auto

Vaz 2104 Zhiguli 1984 97 Avtomobili Retro Avtomobili Avtomobil

1960 Alvis Td21 Classic Cars Cars Antique Cars

What Are The Best Classic Car Auctions In The Uk

Do You Like Vintage Photo Classic Cars Alfa Romeo Alfa Romeo 8c

Posting Komentar untuk "Importing A Classic Car From Europe After Brexit"