Classic Cars Motor Tax Ireland

A vehicle is classed as a vintageveteran once its 30 years old from date of manufacture and a concessionary rate of motor tax applies See List of Motor Tax Rates. Vehicles are exempt from paying vehicle tax if they are 40 years old or older on January 1 2017.

Classic Cars Permanently Exempted From Road Tax In Budget Financial Times

If you car is younger than 30 then the tax is the same as it would be on an everyday car.

Classic cars motor tax ireland. Used Classic Cars for Sale in Ireland. Vehicles Exempt from Irish Motor Tax The following vehicles are exempt from liability to pay vehicle motor tax. Vehicles exempted under the Disabled Drivers and Disabled Passengers Tax Concessions Regulations 1994 SI.

This principle covers vehicles built or registered in 1977. Ad An Open Transparent Tax Regime in a Business Hub at the Heart of Europe. Tax is about 30 Euro.

I have been using a classic car as my daily driver for over five years now and have never looked back. The monthly cost is 10 of the annual rate. For ZZ registration queries please email.

Classic car owners pay just 55 a year but the car in question must be at least 30 years old. No NCTCRW required for Vintage Vehicles. Pick up anything over 30 years old and its only 56.

Appropriate fee -See List of Motor Tax Rates. The right classic will be a reliable fun car to drive costing under 250 in tax and insurance while going UP in value. A classic or vintage car is a car more that 30 years old.

Classic tax is a flat rate of 48 iirc. You should supply the mandatory documentation when registering vintage vehicles. These are some of the reasons why classic car insurance is a bit cheaper than for moderns and also why a nominal rate of motor tax at 48.

Tax Typically for Ireland we have this backwards. Changing the taxation class on any vehicle eligible for Vintage classification requires a declaration on application form RF111 change of particulars httpswwwmotortax. Ouch thatll be 885 a year please.

The half-year payment is 555 of the annual rate. A vintage vehicle is a vehicle proved to be more than 30 years old. Although over 20 qualifies it for vintage insurance - work that one out.

Pay Motor Tax track progress of my disc motor tax refund rates and forms. The VRT rate for category C vehicles is 200. Classic tax only if its ove 30 Im afraid so W124s are out for a good few years yet.

Hope that all helps understand the Irish motor tax system but if you have any specific questions weve not covered feel free to drop us a question via the Ask Us Anything page. Classic bikers pay just 26. Any vehicle body type 30 years old from date of manufacture qualifies as vintage on which a concessionary rate of motor tax can apply.

Change of vehicle ownership and motor tax. You can pay the tax at on the motor tax website. The annual rate for a vehicle between 4000kg and 12000kg is 500 and 900 for vehicles over 12000kg.

Vintage vehicles and ZV plates. This bright yellow Corvette is certainly not for. Many Irish collectors go to the UK to buy but the situation there appears to be equally uncertain.

TEMPORARILY OFF THE ROAD. However sometimes not all of the original documentation is available. There are currently 113 used classic cars in Ireland available to view on CarsIrelandie browse the largest range of classic cars for sale in Ireland.

Declare your vehicle temporarily off the road over the internet. Used Classic Cars for Sale in Ireland. With road tax at 56 in Ireland and typical insurance quotes of less than 200 a classic was very attractive alternative.

Check change of vehicle ownership status procedures replacement VRC incorrect sale date on VRC. IRELAND WILL TAKE in around 21 million this year from tax paid on vintage cars. The quarterly payment is 2825 of the annual rate.

It is possible to own a car with a big engine in Ireland and not pay extortionate motor tax. Cars 30 years or older are considered category C vehicles. In order to qualify for vintage tax the car must be older than 30 years.

Environment Minister Alan Kelly told the Dáil last month that the low-rate tax rates. Since January 2016 the rate of motor tax is reduced for all commercial goods vehicles above 4000kgs. Ad An Open Transparent Tax Regime in a Business Hub at the Heart of Europe.

When Does A Car Become A Classic

When Does A Car Become A Classic

Classic Cars Made In Ireland Delorean Is Only Tip Of Irish Iceberg Go Zip Zap Zoom

1968 Sunbeam Rapier For Sale In Louth On Donedeal Classic Cars British British Sports Cars British Cars

Car Tax Ireland Blog Otomotif Keren

Tax Exempt Cars The Cast Of 2021 Classics World

Man Who Spent 40k Restoring Car Declared Owner By Judge

Lhd 29 Ads In Vintage Cars For Sale In Ireland Donedeal

When Does A Car Become A Classic

Cheap Classic Car Insurance Money Saving Expert

Car Tax Book Ireland Blog Otomotif Keren

Do Classic Cars Need An Mot Check Check Now Kwik Fit

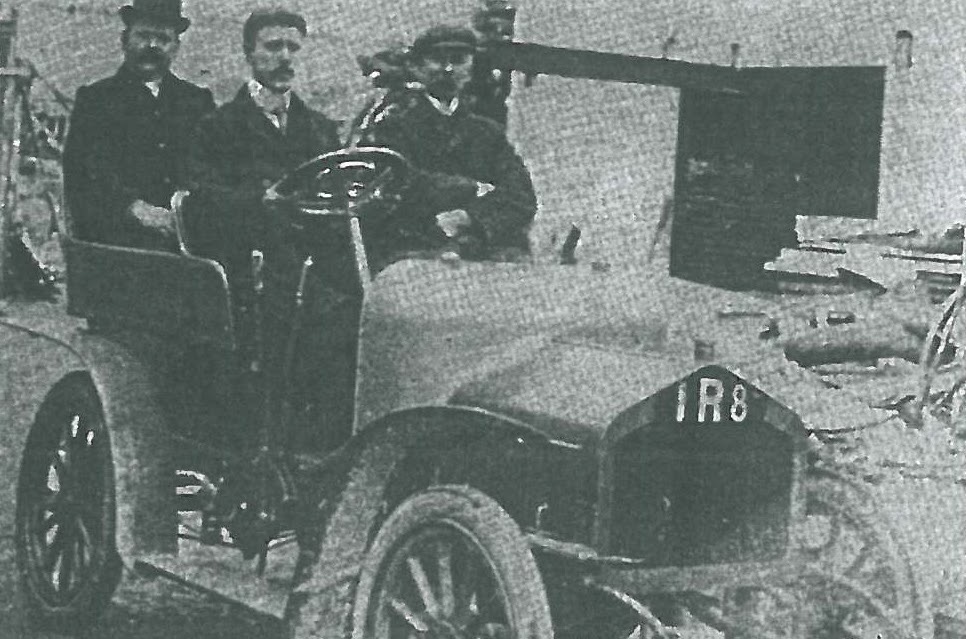

Vehicle Registration Information Irish Veteran Vintage Car Club

Is My Classic Car Eligible For Mot And Road Tax Exemption Lancaster Insurance

The Ford Cortina Twenty Years Of Advertising Britain S Favourite Car Flashbak Ford Classic Cars Car Ford Classic Cars British

Motor Tax Changes May Catch Out More Than Just The Cheats

When Does A Car Become A Classic

Posting Komentar untuk "Classic Cars Motor Tax Ireland"